From Military Service to Financial Freedom: This Entrepreneur is On a Mission and We’re All In

From Military Service to Financial Freedom: This Entrepreneur is On a Mission and We’re All In

By:

As the eldest daughter of a family that just immigrated from Mexico, Violeta was in charge of helping her family assimilate to the United States.

This meant, from that point forward, everything she learned, she had to learn on her own.

The best advice my parents were able to give me was to study hard, save money and avoid debt.

Typically, that is sound advice, but it assumes that one has resources—financial and otherwise—which Violeta didn’t have.

She also had to pay her way through college; which would be a difficult task for anyone who has to cover both their own living expenses and the expense of their college education.

With a low-wage job and then trying to finish college, I was running out of money fast!

To overcome her situation, Violeta joined the U.S. Navy in 2010.

With her new job, she was able to purchase her first car, but it came at a high cost.

Because I had no credit score, and couldn’t pay cash for my vehicle, I had to finance the purchase at a high interest rate.

But, this at least gave Violeta her independence and was the starting point of her financial journey.

Four years later, her salary was high enough to qualify for a home, backed by a VA loan, that she purchased in 2014.

She then found a way to monetize her purchase, turning the liability into an asset.

I “house-hacked” by renting out rooms. Eventually, I turned it into a full-fledged rental.

Three years later, she was able to obtain a bachelor of science in Occupational Health and safety on a full scholarship through the Navy and was promoted and commissioned as a Naval Officer.

She’s now served for over 12 years.

In 2021, she purchased her second home and repeated her initial strategy, except this time she was able to build on the foundation she’d previously established.

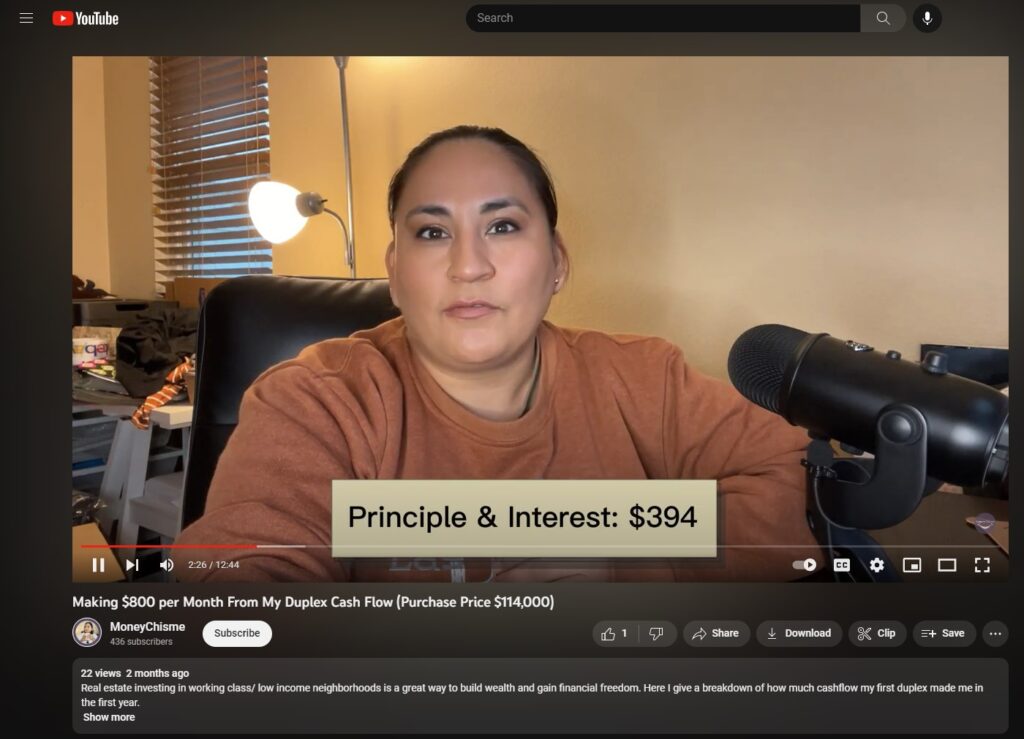

I used a cash-out refinance on my first home to purchase my first duplex in 2021.

She then sold that home to purchase her second duplex and she’s now making plans to scale.

I’m now looking into a third duplex and am planning to scale to a larger multi-unit property.

In just ten years, Violeta has been able to go from having no credit score and being forced to purchase a car at a high interest, to having the kind of credit that allows her to make multiple property investments.

And now she’s using her experience, her know-how, and the financial intelligence she’s gained to teach others how to do the same.

As a First Gen, I know how hard it is to navigate finances—especially how hard it is to build wealth—that’s why I want to teach what I’ve learned.

And that’s what has us excited.

Here at Enora, we are entirely bought in on the idea that with the opportunities afforded by the internet, everyone can build wealth, they just need to know how—something we hope to help teach through our content—and also something that makes Violeta a kindred spirit.

Not only has she been able to carve out a healthy financial path for herself, Violeta is teaching others how to have a healthier financial life too—something every business owner needs to know how to do.

According to score.org (the nation’s largest network of volunteer, expert business mentors),

82% of small businesses fail due to cash flow problems.

Score.org

Their advice for business owners wishing to avoid becoming a statistic?

- Stay cheap

- Protect your credit

- Be smart with purchases

Basically, these are all the things Violeta has learned to do and what she teaches others.

I am so passionate about teaching others how to gain financial stability and freedom, and how to build generational wealth through real estate investing and other avenues.

To that end, Violeta has started a personal finance and investing blog, moneychism.com, as well as a podcast, YouTube channel, and TikTok account.

I’m teaching ambitious first-gen Latinx and people of color how to manage and grow their money without the guilt!

Conclusion

Violeta’s journey is a remarkable example of how determination and financial literacy can lead to success and wealth building.

Her story can also serve as an inspiration to many first-generation immigrants and people of color who may be facing similar financial challenges.

By sharing her knowledge and experience through her blog, podcast, and social media accounts, Violeta is empowering others to take control of their financial lives and achieve their goals.

And as the world becomes more interconnected and opportunities to build wealth become more accessible, those who are seeking to achieve financial stability and independence, need what Violeta is doing more than ever.

The importance of financial education and smart financial decision-making cannot be overstated; which makes Violeta’s message and her mission more relevant—and welcomed—than ever.